7 minutes07/28/2022

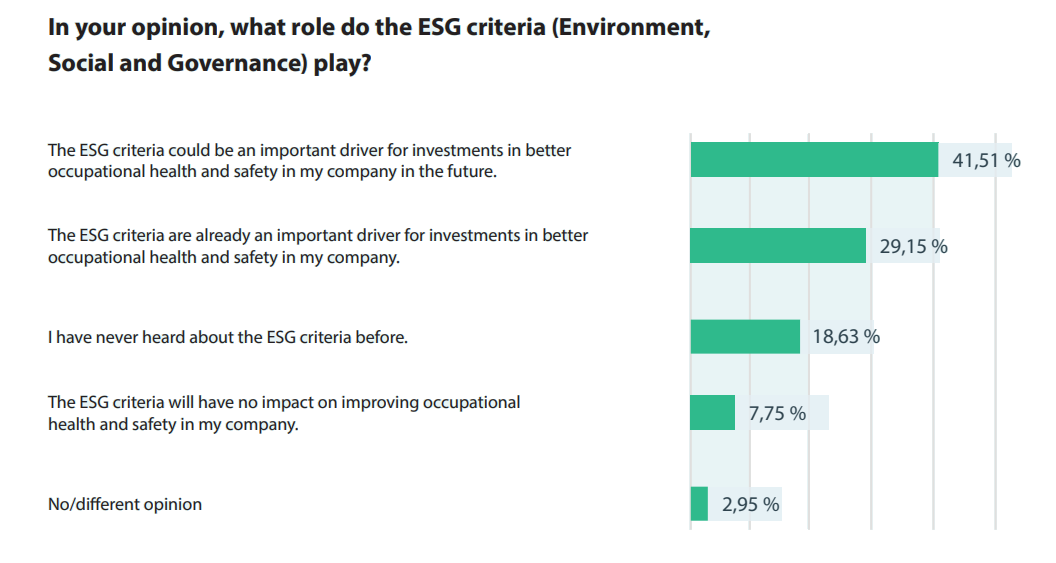

In recent years, people and companies around the world have become increasingly aware of the urgent need for a forward-looking perspective, particularly in relation to industry and production processes. Climate agreements, occupational safety regulations and the European Due Diligance Act are all evidence of the growing pressure to act responsibly now permeating all areas of business. Another example can be found in the financial sector, where classifying sustainable investments based on ESG criteria has gained acceptance. Higher awareness of sustainability in society at large, along with greater environmental consciousness and a stronger sense of global responsibility have all contributed to a visible rise in demand for investment opportunities that fulfill ESG criteria.

An universal ESG classification has the potential to lay foundations for increased social and ecological investments while also incentivizing companies to fulfill these criteria – and thus to do their part to create a responsible future for everyone.