13 minutes8/16/2022

The time of greenwashing is nearing its end. Companies and financial institutions are now obligated to place a clear focus on genuine sustainability. Consequently, sustainable business has become far more than an ethical, normative concept and must instead be supported with hard facts and figures. The requirements of non-financial reporting have increased accordingly. A central element in this shift towards qualitatively measurable sustainability is the EU Taxonomy Regulation. But what does it mean for you and your company? In this article, we discuss the most important facts and explore the background of the EU Taxonomy. Learn the circumstances under which the regulation applies to you, and the requirements that business activities must fulfill to become Taxonomy-aligned. You will also receive a checklist with specific steps to guide you on your journey to Taxonomy alignment, as well as a practical example to help clarify matters. Click on the subpoints below to navigate through the article:

- EU Taxonomy: In brief

- Technical screening criteria and performance requirements

- 7 steps to implement the EU Taxonomy Regulation

- 1. Preparing for sustainability reporting

- 2. Preliminary study

- 3. Identifying business activities aligned with the Taxonomy

- 4. Taxonomy screening to identify substantial contributions

- 5. DNSH (Do No Significant Harm) assessment

- 6. Due diligence assessment for minimum social standards

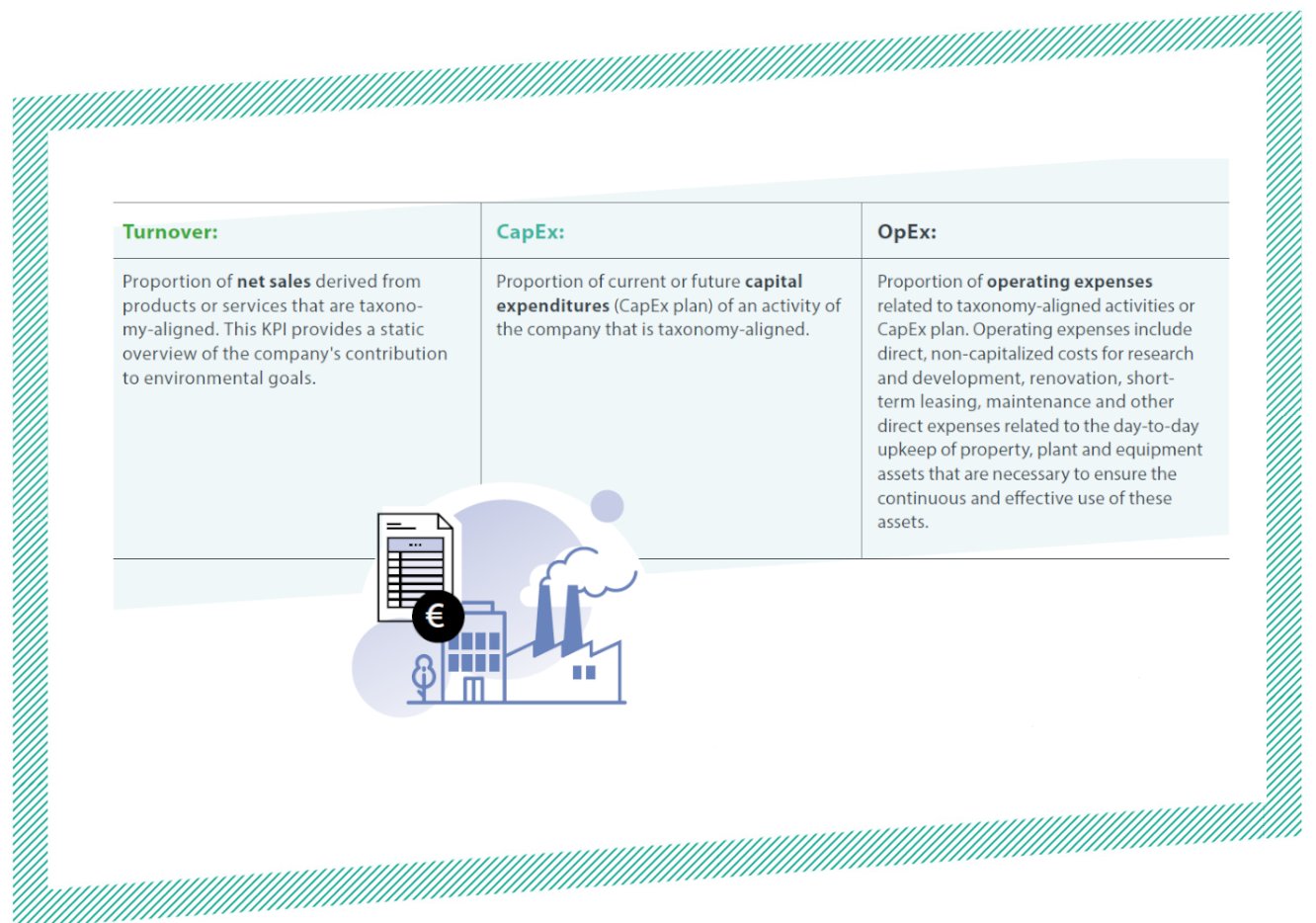

- 7. Calculating financial KPIs

- Example assessment of Taxonomy alignment (based on Weidner 2020)

- Outlook