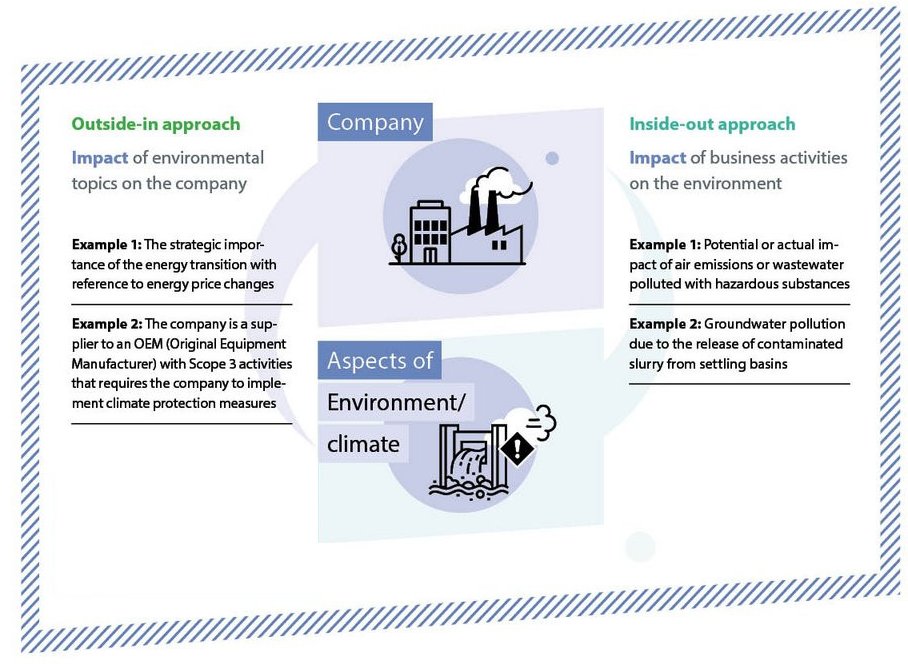

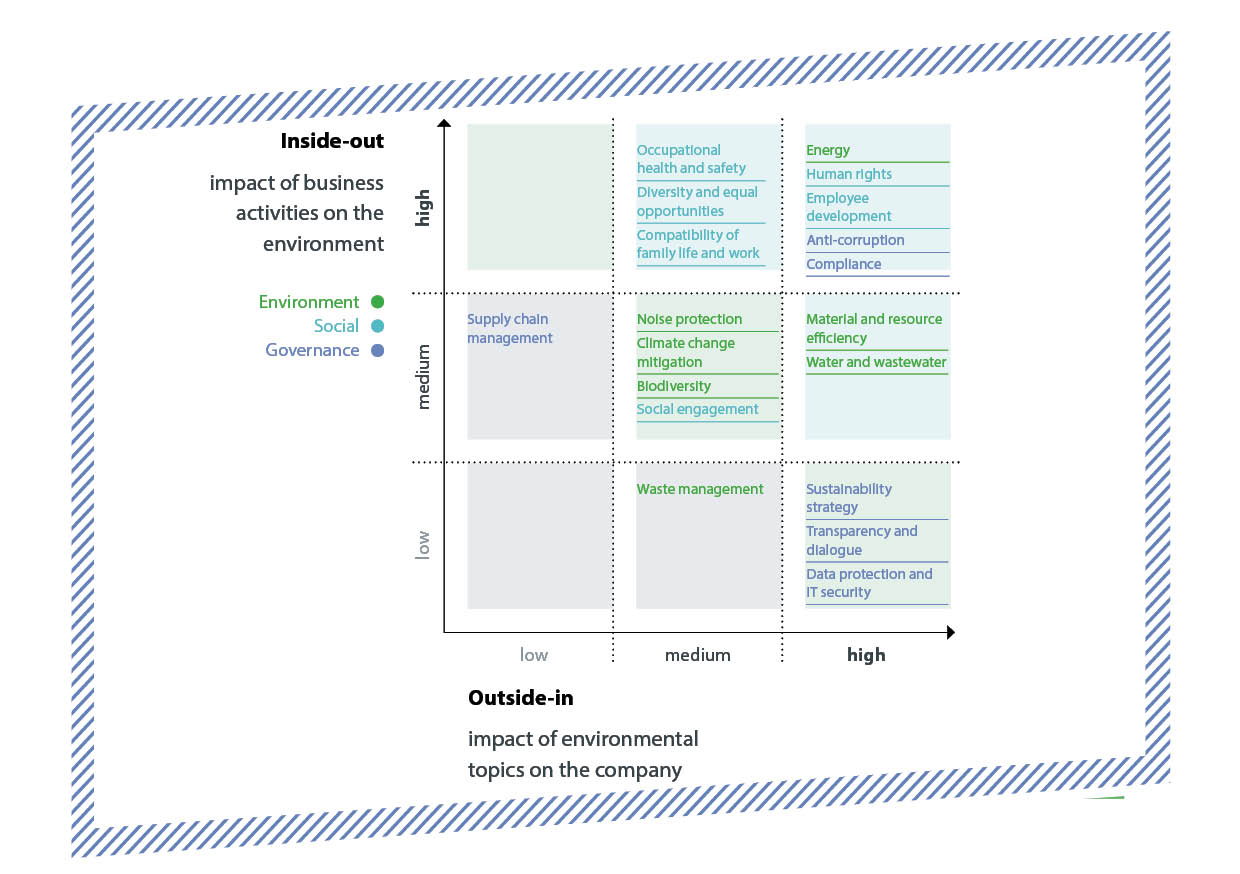

Double Materiality: Outside-in & Inside-out

In 2019, the European Commission was the first to formally describe the concept of Double Materiality in the context of sustainability reporting, and the need to get a full picture of a company’s impacts. Double Materiality is central to the European Commission’s proposed Corporate Sustainability Reporting Directive (CSRD), while it also closely aligns with the materiality approach in the GRI Standards.

Materiality analyses are not new to sustainability management. They represent a robust and frequently used instrument for determining the significance and relevance of sustainability topics for a company. First and foremost, a company should concentrate on the topics that are considered “of material importance”. But what exactly does this mean? Different interpretations do exist, including between reporting standards.

The upcoming revisions to sustainability reporting (EU CSRD) will integrate two perspectives within the context of the concept of Double Materiality:

Outside-In Perspective

The Outside-In Perspective considers the impact of external topics on the company and/or its financial results, e.g., in the form of stakeholder expectations or due to technological changes.

Examples of impacts in terms of the Outside-In Perspective:

- Costs of climate change adaptation

- Insurance costs

- Raw material availability and prices

- Recycling and energy costs

- Demographic change

- Population structure

- Value change

- Equality

- Urbanization

- Conflicts in supplier countries

- Migration

- Political regulation

Inside-Out Perspective

The Inside-Out Perspective considers the company’s impact on sustainability topics, e.g., contribution to climate change.

Examples of impact in terms of the Inside-Out perspective:

- Greenhouse gas emissions

- Water consumption

- Air pollution

- Energy use

- Biodiversity

- Working conditions

- Employee rights

- Trade union rights

- Occupational health and safety

- Human rights

- Corruption

- Bribery