7 Minuten 05.09.2022

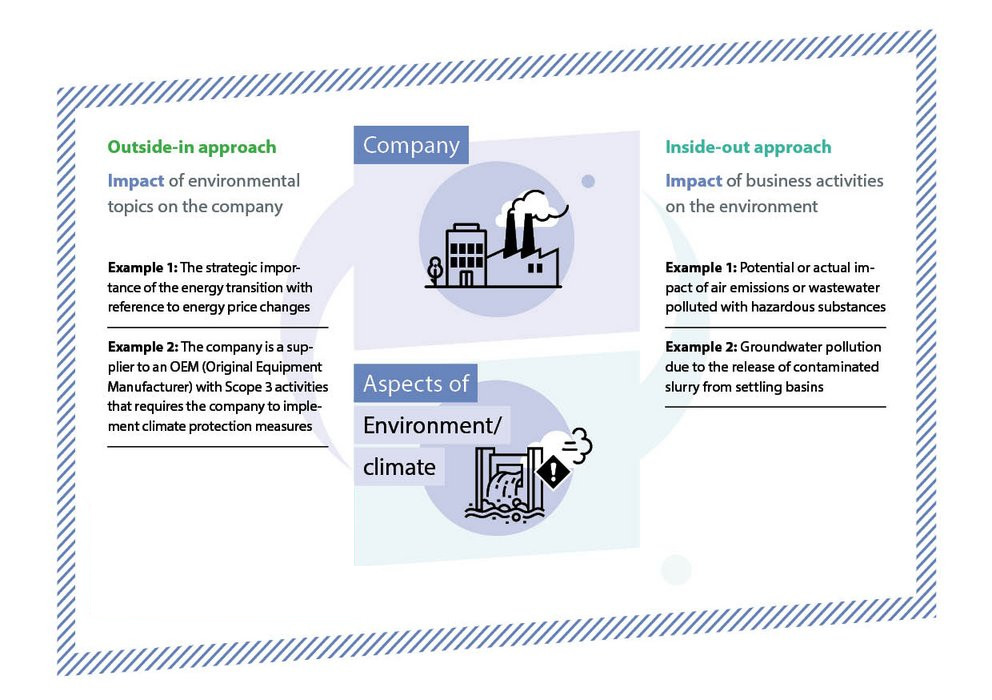

Companies are considered as key players for an overall societal change towards more sustainability. The EU-Taxonomy and corresponding legal requirements have specified a classification system for sustainable business activities, aiming to guide capital flows in a way that supports sustainable development, climate-neutrality, a circular economy and biodiversity. Pressure to demonstrate sustainability in the context of ESG performance is growing. The upcoming revisions to sustainability reporting (as set out in the EU-CSRD guidelines) will also extend non-financial reporting obligations to a far wider range of companies.

Almost all sustainability reports and each ESG report include environmental performance indicators that are directly or indirectly related to a company's activities. In this article, you will find a detailed overview of a variety of environmental KPIs according to GRI, EMAS and the European Commission's guidelines